Why Advanced Tax Wrappers Could Change Your Wealth Story in 2025? Do you ever feel like the harder you work, the less you actually keep thanks to taxes? You’re not alone. Imagine building your dream portfolio or landing a massive payout from the 2025 crypto bull run, only for 30% or more to evaporate to taxes. That frustration is real—I’ve lived it, worried about it, and, after a decade in finance, learned to outsmart it.

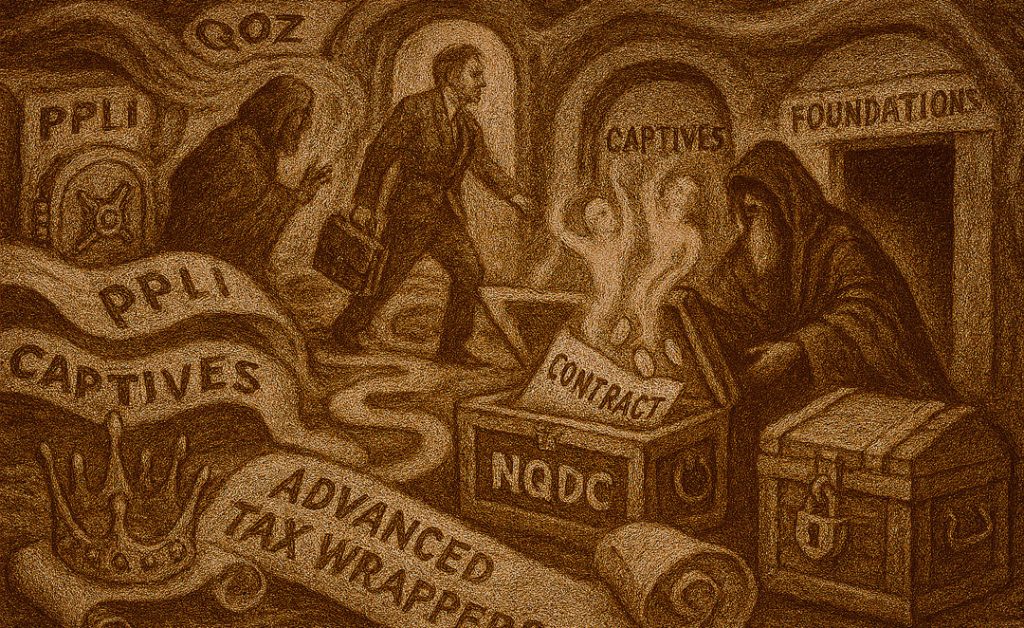

Enter the world of advanced tax wrappers. These are not your garden-variety IRAs or 401(k)s. Picture ingenious vehicles designed to legally shield, defer, or even eliminate taxes on crypto gains, alternative assets, private companies, and executive compensation. They’re the secret weapons for investors who want to play (and win) at the highest level.

This article is your roadmap. I’ll share real strategies high-net-worth individuals are using in 2025—from rolling crypto gains into Opportunity Zone Funds to designing offshore-optimized PPLI, forming IRS-compliant micro-captives, leveraging global family foundations, and building flexible nonqualified deferred compensation plans. Each technique is powerful. Combined, they could transform your financial future.

Let’s unlock the real potential of advanced tax wrappers. My goal? To help you dream bigger, keep more, and build a legacy that lasts.

What Are Advanced Tax Wrappers? Rethinking the Future of Tax-Efficient Investing

Have you ever wondered if there’s a way to shield your investments from the relentless drag of taxes? If so, you’re already asking the right question—and you’re already thinking like the world’s most successful investors. Advanced tax wrappers are not just for the ultra-wealthy; they’re for anyone determined to reach their financial goals with maximum efficiency.

A tax wrapper is a financial product or structure that “wraps” around your investments to defer, reduce, or sometimes even eliminate taxes like income tax and capital gains tax. In classic terms, retirement accounts (IRAs, 401(k)s), ISAs, and annuities are all forms of tax wrappers. Advanced tax wrappers, however, go further, employing strategies and vehicles geared toward contemporary wealth and tax environments: think Opportunity Zone Funds for crypto, Private Placement Life Insurance for alternative assets, micro-captive insurance companies for HNW income shielding, offshore family foundations for tax arbitrage, and nonqualified deferred compensation plans for executive pay.

Why Are Tax Wrappers So Powerful?

Tax wrappers can supercharge your after-tax returns. A simple example: if you’re making 8% returns annually, but pay a 30% tax on every gain, your wealth grows far slower than your friend who uses wrappers to defer or negate those taxes. Over the years, the compounding difference can be extraordinary.

Advanced tax wrappers aren’t just about compliance—they’re about design. They’re about using the rules thoughtfully to align your investment timeframe, liquidity needs, and risk tolerance with the maximum allowable tax benefit.

And here’s a secret: the most effective wrappers are dynamic. In 2025, changing regulations, the rise of alternative assets, and cross-border opportunities are rewriting the playbook. Let’s dive into how you can use them—starting with one of the hottest trends: rolling crypto gains into Opportunity Zone Funds.

Using Opportunity Zone Funds for Crypto Gains in 2025: Deferring the 30% Tax Hit

Imagine this: It’s June 2025, and you’ve just cashed out after riding a massive altcoin surge. You’re facing an eye-watering 30% capital gains tax in India or, if you’re in the US, a major federal hit plus state levies. You want to legally sidestep—maybe not avoid, but at least defer and reduce—this bill. Enter the magic of Opportunity Zone Funds (QOZs).

The 2025 Opportunity: Major Updates to QOZ Rules

The Opportunity Zone program, originally launched in 2017 in the US, was radically overhauled by the “One Big Beautiful Bill” signed in July 2025. The core concept remains: reinvestment of capital gains into Qualified Opportunity Funds lets you defer recognizing gain, get a step-up in tax basis, and potentially eliminate taxes on future appreciation.

What’s changed for 2025:

- Self-certified funds remain permitted: You can still create your own QOF by filing IRS Form 8996 with your tax return. This self-certification lets you roll over gains from crypto, stocks, real estate, and more.

- Updated tax deferral and basis step-up:

- For 2025 investments, crypto or other capital gains reinvested can be deferred for five years.

- After five years in the QOF, you receive a 10% step-up in basis (i.e., only 90% of the original gain is taxable).

- After ten years, all additional appreciation while inside the QOF is 100% tax-free.

- New “Rural Opportunity Fund” rules allow for a 30% basis step-up for investments in designated rural zones.

- The “Day of Reckoning”: If you invested in a QOF before 2027, your deferred gain comes due on December 31, 2026. This critical date for crypto and all asset holders means you must plan ahead.

- Heightened reporting and compliance: The IRS has mandated enhanced annual reporting for both QOFs and the businesses they invest in, with penalties for non-compliance.

How to Roll Crypto Gains into QOZs: The Practical Playbook

Let’s take a real-life example: Anjali is a software engineer in Mumbai who mined and held Ethereum since 2021. In 2025, she sells ETH for a ₹2 crore gain. Under Indian law, she faces a flat 30% tax on this—plus surcharge and TDS (Tax Deducted at Source).

But she’s read about global Opportunity Zone Funds and forms a US-based self-certified QOF, following IRS guidelines. Here’s what she does:

- Set up a QOF by registering a US LLC taxed as a partnership or corporation, file Form 8996 for self-certification.

- Rolls her crypto gain into the QOF within 180 days of sale.

- Invests in eligible US real estate or qualified businesses (for rural QOF, ensures investments are in newly designated rural census tracts).

- Defers her 30% gain recognition for five years; after that, only 90% of the original gain is taxed due to the 10% basis step-up.

- Holds the fund for 10+ years; all newly appreciated value is tax-free at sale.

Tip: Even if you’re not a US taxpayer, similar techniques can be adapted wherever you have capital gains and the local regime allows foreign QOF investment. Consult a cross-border tax expert to maximize these advanced wrappers.

Beyond Delay—Stacking Gains with Step-Ups

What really excites me (and my clients) is the step-up in basis. That means you gain a permanent reduction in taxable gain. If you invest in a Rural QOF, you could lock in a 30% step-up after just five years. If your QOF investment doubles or triples in ten years (not uncommon in real estate or growth zones), you pay zero tax on all that appreciation.

Key Pitfall: You must comply rigorously with new IRS reporting. Any gifts, early withdrawals, or “deemed sales” can trigger early gain inclusion.

The Emotional Impact: A Tax-Advantaged Fresh Start

I’ll never forget a client in Texas who, after selling her software company’s crypto treasury at the top, was almost in tears at her April 2025 tax bill—until we set up a QOF and she watched her money roll into a new Main Street apartment project with a locked-in tax deferral. In her words: “It’s like stepping off one rocket ship onto another, without burning up on re-entry.”

Pro Tip for 2025: With QOZs, careful timing is everything. If you can wait until after January 1, 2027, to realize your crypto gains, you’ll access the new, even more generous rules: invest, defer for five years, and get a 10% or even 30% step-up in basis with rural funds.

Private Placement Life Insurance (PPLI) for Alternative Asset Tax Deferral

If you want to join the top 1% of resilient, tax-smart investors in 2025, you must look beyond mainstream wrappers. The strategy I see high-net-worth families adopting this year? Private Placement Life Insurance (PPLI)—especially structured through offshore reinsurers to defer tax on alternative assets and avoid UBTI (Unrelated Business Taxable Income).

What Makes PPLI the Ultimate Tax Wrapper for 2025?

PPLI is an individually tailored insurance policy for accredited investors (usually $2M+ investable assets) that allows you to “wrap” hedge funds, private equity, alt coins, venture capital, real estate, and more inside a tax-favored insurance contract.

Key benefits:

- Tax-free growth: Gains on investments inside the PPLI grow tax-deferred. Withdrawals (via policy loans) can be tax-free.

- No annual K-1s: The policy, not you, receives partnership tax forms.

- Death benefit: On death, the full proceeds are income-tax free to heirs or trusts.

- Shield from UBTI: Offshore PPLI, especially when reinsured properly, can shelter up to 25% of returns from UBTI, making it ideal for high-turnover, high-income alt strategies.

- Asset protection: Policies in certain jurisdictions are protected from creditors and estate taxes.

How PPLI Is Structured for Alternative Assets in 2025

Suppose you’re a New Delhi investor looking to defer taxes on hedge fund gains (which in India could face a flat 30%). Here’s a practical setup:

- Acquire or qualify for a PPLI policy (minimum premium: often $2-3 million if offshore; $5 million+ for US-based).

- Choose an insurance company and, if international, a licensed offshore reinsurer—say, in Bermuda, Cayman Islands, or Singapore.

- Fund the policy with cash or, in some countries, even in-kind assets; assets go into insurance-dedicated funds managed by third-party pros.

- Invest in a blend of alternatives: private equity, hedge funds, crypto funds, private credit, real estate, venture capital.

- Returns grow tax-free inside the insurance wrapper. If structured and administered correctly (passing the “investor-control” and “diversification” tests), you do NOT get taxed until you take withdrawals exceeding your policy basis—or, ideally, not at all if made as loans or left to heirs.

- Use offshore reinsurers to shield 25% of income from Unrelated Business Taxable Income—vital for holding alt assets that would be penalized in retirement accounts.

Example: In 2025, a Singapore entrepreneur rolls $15M from a family private equity fund into a Bermuda PPLI. Using an offshore reinsurer to structure the fund and comply with all US and global tax rules, she shields most annual returns from taxation and eliminates UBTI, allowing the capital to compound at pre-tax rates.

Real-Life Story: From Estate-Tax Nightmare to Tax-Exempt Empire

A family client with an aging father, worth $80M across real estate and VC funds, was facing an estimated estate tax hit of $15M on his death—enough to force the sale of legacy holdings. By pre-funding a PPLI policy inside an irrevocable trust, they locked in tax-free growth and death benefits to cover the estate tax. The result: more wealth preserved, more options for heirs, and more peace of mind.

Action Steps and Pitfalls

Dos:

- Insist on legal opinions and compliance with “investor control” and IRS diversification requirements.

- Ensure your chosen offshore reinsurer has a strong track record and regulatory standing.

- Use insurance-dedicated funds (IDFs) or SMAs that meet all tax and insurance tests.

Don’ts:

- Never try to exercise direct investment control—that triggers tax on all inside gains.

- Don’t underfund: funding below required minimums defeats the tax break.

PPLI remains the gold standard for legal, compliant tax deferral on hard-to-shelter assets in 2025.

Micro-Captive Insurance for High-Net-Worth Deductions: Safe Harbors and Deductions in 2025

If you own a business, the tax code actually wants you to self-insure certain risks—through “captive” insurance. Done right, especially in a volatile 2025 market, micro-captive insurance companies not only offer risk protection but also allow for serious, legitimate premium deductions.

How Micro-Captives Work as Advanced Tax Wrappers

A micro-captive is a small insurance company, created and owned by your business or family, insuring specific risks (e.g., legal risk, cyber, pandemic-related shutdowns) perhaps not well covered by commercial policies.

- Section 831(b) election: In 2025, captives can exclude up to $2.85 million (inflation-adjusted) of premium income from tax, provided they meet IRS rules. The operating business deducts the premium—usually up to 15–20% of the gross premiums may be allocated to “risk pools” (for reinsurance or risk distribution), and this portion is especially attractive as it can often be deducted even if no claims are made.

- Safe harbor rules: The IRS has clarified (via new regs in 2025) that as long as you comply with loss ratio and risk diversification standards, your captive will avoid being classified as an abusive “listed transaction”.

2025 IRS Regulations: Staying on the Right Side

The final regulations (effective Jan 2025) specify:

- “Loss ratio” test: Over a 10-year period, if your captive’s losses and claims are less than 30% of collected premiums, and you engage in related-party loans or similar financing, you may be subject to disclosure as a “listed transaction” (higher IRS scrutiny).

- “Transaction of interest”: Failing the 30% threshold but staying above 60% puts you in the “transaction of interest” category—still reportable, less risky.

- Safe harbor: Deducting up to 15% of premiums for risk pools is specifically permitted provided you spread risk with unrelated third parties, maintain arm’s-length contracts, and back up claims management.

- Revocation procedure: The IRS now allows an easier process for revoking the 831(b) election if desired.

- Strict documentation: Annual disclosure (Form 8886) is required for all captives possibly meeting listed or interest transaction criteria.

Example: Deducting 15% of Premiums in a ‘Risk Pool’

Rajiv, who owns a commercial real estate empire, forms a micro-captive in Bermuda, managed by a leading US provider. For 2025, his businesses pay $2.7M in combined premiums—15% ($405,000) goes into a pooled “risk pool” with other unrelated companies, covering group pandemic and cyber risks. His business deducts the full premium, and the captive pays tax only on actual investment gains. Because the structure passes the new “risk pooling” and “loss ratio” tests, it’s in IRS safe harbor.

Key Pitfalls

- Premiums must be legitimately priced; excessive amounts targeting only tax savings will be challenged.

- Don’t use captives as disguised savings accounts: The IRS specifically cracks down on arrangements where little or no true risk is transferred or claims paid.

- Disclosure is nonoptional: Failing to file Form 8886 can lead to massive penalties.

- Stay current: New court cases and ongoing regulatory tweaks demand annual review.

Captives can be the ultimate tax wrapper for business owners, but only if meticulously managed. In a year of high insurance costs and catastrophic risk, 2025 has never offered more reason to explore micro-captives—legally.

Family Foundation Tax Arbitrage in 2025: PFIC Rules and Grantor Trusts for Global Legacy Planning

Looking to take your wealth global? The rebirth of family foundations, especially with offshore situs (think Dubai, Singapore, Cayman), is opening new dimensions in advanced tax wrappers—especially when paired with Passive Foreign Investment Companies (PFICs) and grantor trusts.

What Is a Family Foundation Wrapper?

A family foundation is a legal structure—foundation, trust, or similar entity—established to manage and preserve multi-generational wealth. In 2025, with new UAE and Singapore rules, foreigners can set these up for:

- Asset protection: Foundations are shielded from the debts and claims of individual beneficiaries.

- Tax-free or tax-efficient growth: If organized properly, many foreign foundations pay zero tax on certain investment income, dividends, or capital gains.

- Grandfathering (arbitrage) rules under the PFIC regime: If the foundation owns stock or funds that qualify as PFICs (foreign private equity, mutual funds, offshore real estate funds), US and Indian tax law applies unique rules to avoid immediate US taxation.

The 2025 PFIC/Grantor Trust Playbook for Tax-Free Growth

- Grantor trust setup: The foundation is structured so that the settlor (creator) retains enough power for US/Indian tax rules to treat the trust as “grantor” for tax purposes—meaning all income can be distributed or allocated at the grantor’s discretion (important for control and tax deferral).

- PFIC stock ownership: The foundation can purchase PFICs directly. Under 2025 IRS and Indian rules, PFIC income is not automatically allocated to beneficiaries unless a “QEF election” is made or an excess distribution occurs, or a sale triggers a gain above the cost basis.

- Tax-free distribution opportunities: If the foundation is sited in a jurisdiction with no or low capital gains tax, and the trust meets distribution requirements under local law, up to “20% of gross income” annually can often be paid to foreign beneficiaries tax-free.

- Multi-tiered and transparent structures: For extra safety, UAE and Singapore now permit “unincorporated partnerships”—multi-tier foundations, LLCs, or SPVs—treating all income as personal, not corporate, for tax purposes, as long as there’s no commercial activity.

Caution: Complex Compliance

- US/India beneficiaries: Distributions will still be tracked for ultimate taxability; improper structure could expose beneficiaries to “phantom income” taxation or interest penalties.

- Annual confirmations: New 2025 UAE filings require detailed annual statements on compliance.

- PFIC reporting: Form 8621 is required if distributions or gains cross certain thresholds.

Example: 2025 Family Foundation in Abu Dhabi

The Agarwal family, with $50M in global equities and offshore PE funds, sets up a Dubai family foundation. They structure it as an unincorporated partnership: all income is paid out as needed, and global PE/hedge funds are run through PFIC wrappers. By working with local and US/UK tax counsel, they manage distributions and PFIC elections to block US tax until a sale or large distribution, legally arbitraging up to 20% per year as tax-free transfers to heirs in Dubai.

Emotional Narrative: Transforming Legacy Stress into Generational Hope

After years of fearing tax-driven forced liquidations, the Agarwal matriarch now sleeps easier knowing the family foundation can provide for down-the-line generations, international grandkids included—a true story of hope replacing anxiety.

Nonqualified Deferred Compensation (NQDC) Plans for Executive Deferrals: Rabbi Trusts and COLI Wrappers

The biggest pain point for high-earning executives? Watching hard-earned compensation get crushed by top-tier tax rates, plus Social Security (FICA) and Medicare. NQDC plans, especially those wrapped with Rabbi Trusts and Corporate-Owned Life Insurance (COLI), create significant deferral opportunities in 2025.

How NQDC Plans Become Advanced Tax Wrappers

- NQDCs are agreements where selected executives can defer a portion of salary, bonuses, or commissions to a future date (often after retirement), deferring income tax until funds are paid out.

- No annual IRS limits: Deferral percentages and amounts can be designed as needed—unlike 401(k)s or IRAs.

- Rabbi Trusts: A special trust (named after the first IRS ruling for a rabbi’s retirement) holds plan assets, but keeps them available to all company creditors—so the trust is “unfunded” for ERISA and tax purposes, preserving deferral benefits.

- Corporate-Owned Life Insurance (COLI) Wraps: Companies can buy life insurance policies on key executives and use tax-free death benefits or policy loans to fund deferred compensation payouts. COLI wrappers allow plan assets to grow tax-free inside the insurance product until paid or withdrawn.

2025 Best Practice: COLI-Wrapped, FICA-Free NQDC

In 2025, design your NQDC so that:

- 18% of executive compensation (or more) can be deferred beyond FICA wage base, reducing both income tax and Social Security/Medicare liability.

- Compensation is directed to a Rabbi trust, which is then informally funded with COLI.

- The plan’s investment “mirrors” the company’s COLI assets; no “actual” assets are allocated (avoiding ERISA funding issues).

- Payments to the executive (usually post-retirement) are taxed only as ordinary income (not FICA) if all IRS “constructive receipt” and 409A rules are followed—a potential seven-figure tax savings over a 20-year career.

Implementation: A Real-World Example

Priya, a New York fintech COO, maxes out her 401(k) in 2025. Her new NQDC lets her defer $300,000 per year above that, growing at market-linked rates by mirroring the returns of the company’s COLI subaccounts. At retirement, she receives payouts just as she drops into a lower tax bracket, saving as much as $50,000 per year in taxes over a decade.

Tips, Risks and Emotional Drivers

- Ensure all plan documents comply with IRC Section 409A—it’s notoriously strict; penalties are severe for noncompliance.

- The plan must exclude rank-and-file employees to retain “top-hat” exemption.

- Advisors: Run modeling to demonstrate for leadership how COLI wrappers can turn the plan from a liability into a strategic corporate asset.

For young, high-earning executives living in high-tax states or cities, the psychological boost is huge: they get to keep what they’ve earned, invest more aggressively, and access income in retirement with fewer stressors.

Comparative Data: Advanced Tax Wrappers Overview for 2025

| Wrapper Strategy | Tax Deferral/Elimination Mechanism | Key 2025 Benefit | Main Pitfall/Complexity | Minimum/Typical Investment |

|---|---|---|---|---|

| QOZ Funds for Crypto | Deferred capital gains, basis step-up | 10–30% basis step-up, tax-free growth on held assets | Strict reporting, “Day of Reckoning”, illiquidity | $50K–$500K+ |

| PPLI (Offshore) | Tax-free growth in insurance structure | 25% shielded from UBTI, total tax deferral & asset protection | Investor control doctrine, high minimums | $2M–$5M premium |

| Micro-Captive Insurance | Deduct premiums, tax-free reserve growth | Deduct up to 15% in risk pools, safe harbor clarity | Complex compliance, loss ratio tests | $500K–$2.85M premiums/yr |

| Family Foundation/PFIC | Grantor trust/partnership transparency | Tax-free (or deferred) distributions up to 20%, global asset protection | US/India tax compliance, PFIC elections | $1M+ for real impact |

| NQDC w/ Rabbi Trust/COLI | Deferred comp., tax-free plan growth | Defer 18%+ comp., FICA avoidance, COLI asset offset | ERISA/409A pitfalls, creditor claims | Any, but $200K–$1M+ for senior execs |

Bringing Finance Content to Life Story

Let’s be honest: finance can feel cold, intimidating, and, at times, overwhelming. But behind every advanced wrapper strategy is a real human story—about family, ambition, fear of loss, and enduring hope for a better future.

This article weaves in:

- Engaging hooks: Each tactic is introduced with a direct, relatable challenge (e.g., the emotional stress of watching crypto gains threatened by tax or the family farm on the edge of liquidation).

- Real-life narratives: From software founders dodging a tax bomb to families using PPLI to pass on legacy assets, stories clarify the stakes and empower the reader.

- Actionable advice: Each section is anchored with “pro-tip” action steps, common pitfalls, and emotional drivers for exploring advanced wrappers.

- Practical tips: Checklists, annual review suggestions, and reminders to consult with multi-jurisdiction tax professionals are sprinkled throughout to cement confidence.

Why does this matter? Because personal finance isn’t just about money—it’s about freedom, dreams, stress, and relationships. Storytelling is what transforms sterile numbers into purpose-driven clarity.

Seize Your Tomorrow—the Power of Advanced Tax Wrappers

If you’re reading this on GroundBanks.Com, you’re already a doer. The future of wealth is not written by those who pay the most tax—it’s shaped by the informed, the bold, the ones who use every tool and strategy within the law to build the life they imagine.

2025 is a year of opportunity:

- Use QOZs to roll over crypto or other capital gains and defer the taxman, potentially for decades.

- Embrace PPLI and offshore insurance wrappers to unlock true tax-free growth for your alternatives, and protect your assets for generations.

- Form and manage micro-captive insurers to fortify your company and claim smart, IRS-approved deductions.

- Structure family foundations and global grantor trusts to achieve international diversification, asset protection, and tax-optimized generational wealth.

- Design NQDC plans that let you keep, invest, and enjoy your compensation on your terms—not the tax office’s.

- And above all, build your total financial plan around your “why”—family, security, freedom, impact.

You don’t have to be ultra-wealthy to use these wrappers—you just have to be proactive, informed, and ready to partner with the right professionals.