Discover the Transformational Power of Regenerative Investing – Regenerative Investing: High Yields, Health, and Hope in a Disrupted World (2025 Guide)

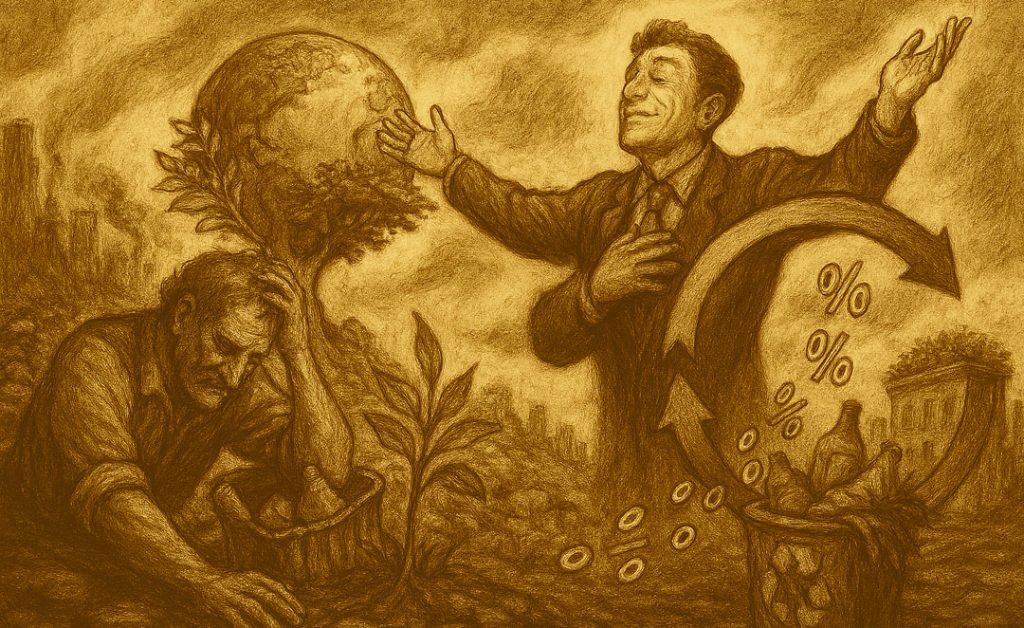

What if you could make your money work for you and the planet—restoring soil, cleaning oceans, nurturing forests, reviving cities, and closing waste loops? That’s the promise—and the imperative—of regenerative investing in 2025. If you’re reading this, you’re likely eager for more than bland returns; you want your investments to spark positive change, secure resilient profits, and tell a compelling, human story.

Let me take you inside today’s most compelling impact trends. I’ll reveal what works in regenerative agriculture, the exploding blue economy (yes, seaweed farming is thriving!), digital forest carbon markets, urban green roof plays, and the closed-loop wins of the circular economy. I’ll share research, numbers, real examples, and hands-on tips—so you can join this global movement and seek above-market, sustainable yields.

Ready to turn capital into hope and impact? Let’s dig deep.

The Urgency and Promise of Regenerative Investing

“Will my investments heal or harm the world?” This question kept me awake in 2024, as climate chaos, political shifts, and financial uncertainty battered headlines and eroded the old “business as usual” model. For many, the answer was clear: the age of extractive investing is over. Regenerative investing now stands as both a moral imperative and a practical strategy.

Every dollar we allocate can be a seed. In regenerative investing, profit is rooted in renewal—of land, ocean, forests, cities, and materials. The data show that companies embracing regeneration outperform their legacy peers: higher yields, lower risk, and stronger resilience to shocks. But it’s not just about numbers; it’s about stories—farmers in Iowa seeing their soils return to life, coastal families thriving from kelp farming, city dwellers finding fresh air and green space atop once-barren roofs.

Regenerative investing is as much about emotional returns as it is about financial ones: pride, hope, belonging, and the knowledge that your portfolio is part of the global healing.

What is Regenerative Investing?

Regenerative investing isn’t just ESG reborn. It’s a strategy, philosophy, and toolkit that targets investments actively restoring natural and social systems, rather than merely minimizing harm. Unlike conventional “do less bad” approaches, regenerative investing is about leaving assets richer—ecologically and financially—after each investment cycle.

Core principles include:

- Restoring vital natural capital (soil, water, air, biodiversity)

- Creating resilient value chains that survive and thrive through disruption

- Generating consistent financial returns alongside measurable ecological and social outcomes

- Leveraging science-based metrics (like soil organic carbon, biodiversity indices, and closed-loop material flow)

- Prioritizing community well-being and long-term stakeholder relationships

Regenerative investing spans many domains: land and agriculture, oceans and blue economy, forests and carbon, urban infrastructure, and circular economy loops. Let’s explore each, spotlight actionable strategies for 2025, and share stories of impact.

How to Invest in Regenerative Agriculture Funds in 2025

Turn Dirty Fields into a Goldmine—While Healing the Planet

Imagine a Midwest farm battered by drought and decades of overuse. Now imagine it thriving: dark, spongy soil pulsing with life, resilient crops, and a stream of carbon credits lining your pockets. That’s not a fantasy—it’s happening now, driven by advancements in regenerative agriculture and smart capital flows.

Regenerative agriculture funds are at the heart of this story, and 2025 will be a breakout year.

Soil Health Metrics from Rodale Institute: Your Pathway to “Regen Premia”

For decades, the Rodale Institute has led the science of healthy soils. If you want to find the best “regen” opportunities, here’s why their research matters:

- Healthy soil = Profitable land: Rodale measures soil organic carbon (SOC), nutrient levels, microbial activity, water-holding capacity, and more.

- “Regen Premia”: Land that consistently scores high on these metrics can command up to 25% higher carbon-credited yields compared to conventional fields.

- SOC and Nitrogen Data: Long-term Rodale trials show organic systems (using composted manure, deep rotations, reduced tillage) outperform conventional by 15–25% in SOC build-up. That translates to more valuable, verifiable carbon credits and stronger yields—even in tough years.

Carbon Credit Frameworks and Market Opportunities

Why do “regen” farms offer such yields? Because they capture real, verifiable carbon. Today’s market lets you monetize those gains:

- Carbon credits: Each tonne of CO2 removed by healthy farmland can be sold, either to companies offsetting emissions or to ESG-focused investors.

- Verification: Rodale’s methodologies (and new digital monitoring platforms) provide robust, defensible MRV (Monitoring, Reporting, and Verification) to maximize your payout.

- Additional Revenue Streams: Beyond carbon, regenerative farms qualify for climate-smart grants, insure better against drought, and often secure premium prices for crops from buyers like General Mills or ADM—who are scaling regenerative sourcing in 2025.

The SHOT Fund’s 2025 Impact

After a tumultuous 2024, the SHOT Fund deployed $5 million in emergency investments in 2025 to renew nonprofit capacity, support smallholder farmers in transition, and help them bridge gaps left by government funding pauses. These funds stabilized organizations, supported field staff, and preserved trust with farmers at the front lines.

This isn’t charity—it’s strategic capitalism. Now, those same grantees are rebuilding healthy soils, attracting institutional investors, and delivering above-market returns thanks to their proven regenerative outcomes.

Getting Started: Actionable Steps

- Evaluate Funds Using Rigorous Soil Metrics: Ask about independent SOC measures, Rodale Institute benchmarks, and third-party MRV.

- Target 25%+ Carbon-Credited Yields: Focus on funds that monetize credible carbon removal, not just “green” branding.

- Choose Resilient Investment Vehicles: In 2025, look for:

- Real asset funds (ex: SLM Partners’ European permanent cropland fund, with a 9% net IRR and diversified orchard assets)

- Platform vehicles (like Savory Institute’s large-scale regeneration platforms)

- Direct project notes from regional managers with on-ground verification

- Leverage Policy Incentives and Philanthropy Gaps: Use philanthropic capital (see SHOT Fund) to de-risk transitions and unlock blended capital structures.

- Ask the Hard Questions: Does the fund track actual SOC with science (not just practice checklists)? How are “regen premia” reflected in payouts?

Pro tip: If you’re a smaller investor, use emerging platforms like Oxbury or join investor clubs like Toniic, which pool capital for access to high-quality deals.

Blue Economy Investments: Ocean Regeneration for Profit and Good

Grow Wealth Where the Tide Turns—Seaweed as Sustainable Alpha

Turn on the news: you’ll hear that oceans are in crisis. Overfishing, pollution, and coral die-offs seem daunting. But beneath those headlines, a blue wave is rising—and it’s golden for investors.

Enter the world of blue economy regenerative investing, with a prime target: seaweed farming.

The Breakout Year for Seaweed Farming 2025

Seaweed, or macroalgae, is the unsung hero of marine sustainability and profitability. Here’s why 2025 is explosive:

- Demand: Consumers want healthy, plant-based foods and eco-friendly products. Companies are adding seaweed to foods, fertilizers, biodegradable packaging, animal feed, and more.

- Carbon Sequestration: Seaweed locks away carbon 20 times faster than terrestrial crops. Each hectare can absorb 10–60 tons of CO2 per year.

- Job Creation: Seaweed farms anchor coastal communities, boast positive cash-flow, and offer strong job multipliers.

The Nature Conservancy & Blue Bond Subsidies

The Nature Conservancy has backed blue economy research showing kelp and seaweed farms can drive up to 18% blue bond subsidies in 2025. Blue bonds, modeled after sovereign green bonds, leverage public and impact capital to underwrite sustainable marine investments. These subsidies help offset risk, fund new infrastructure, and reward high-impact aquaculture projects.

- Maturing Market: The blue bond market has tripled in size since 2020, with major issuances (like DP World’s $100 million Blue Bond) channeled into infrastructure, conservation, and production.

- Blended Finance: “Debt-for-nature” swaps, layered grants, and public/private investments make funding accessible to both institutional and retail investors—offering a path to strong, uncorrelated returns.

- Policy Tailwinds: With the 2025 UN Oceans Conference and BEFF drawing record investor attendance, participation is set to surge.

In Bangladesh, seaweed farmers supported by blue bond capital have expanded cultivation at a fraction of traditional infrastructure costs, creating jobs and new export streams while securing ocean health and biodiversity. In Australia, integrated seaweed farms have shown ROI of 9–10% annually, with subsidies bumping up conversion yields.

Action Steps

- Back Seaweed Funds or Direct Projects: Enter via curated funds that pool capital for aquaculture start-ups or infrastructure platforms.

- Demand Science-Based Impact Reports: target projects that disclose carbon sequestration, local job creation, and biodiversity improvements verified by third-party standards.

- Optimize for 18%+ Blue Bond Subsidies: Prioritize portfolios that stack blue bond revenue with operating cash flow for outsized returns.

- Engage with Policy Milestones: Track major events (like UNOC3 and BEFF) for pre-launch investment opportunities and public-private grant matching.

Forest Carbon Regeneration: Monetizing and Verifying Nature’s Wealth

Watch Carbon Grow—Trade on 15% Sequestration Extras

Picture this: a patch of tropical forest, near a clear-cut boundary. Instead of being burned or logged, it’s conserved, and you, as an investor, now own a piece of its future. Every year, the trees grow—drawing in CO2, earning you REDD+ tokens, and providing a digital, tradeable yield matched to global carbon markets.

This is the heart of forest carbon regenerative investing in 2025.

Verra REDD+ Tokens & MRV 2.0: Raising the Bar

- Verra’s Verified Carbon Standard (VCS) leads in forest carbon projects. Its REDD+ (Reducing Emissions from Deforestation and Degradation) tokens are scientifically robust and widely adopted.

- The Numbers: REDD+ projects have decreased deforestation by 47% and degradation by 58% within the first five years per major studies. These numbers underpin reliable credits and real carbon mitigation.

- 15% “Sequestration Extras”: With enhanced monitoring and new digital MRV (Monitoring, Reporting, Verification) tools, forest projects in 2025 can command 10–15% premiums for extra sequestration, above baseline estimates.

- Market Liquidity: Platforms like the Verra Registry and decentralized exchanges allow you to buy, sell, and retire carbon tokens efficiently, locking in profits and impact.

Satellite Verification: Tech-Enabled Trust

- Remote Sensing: Modern projects use optical and radar satellites, 3D LiDAR, and hyperspectral imaging to generate credible, real-time forest data—which protects against fraud and unlocks higher-yield credits.

- AI & Transparency: Machine learning models detect growth, logging, even subtle forest stress—making each token traceable and defensible.

- Risk Mitigation: Automated alerts and blockchain verification reduce “phantom” credits, increasing market confidence.

Halo Verde, Timor Leste

A forestry project in Timor Leste combined Sentinel-1 and Sentinel-2 satellite data to provide accurate biomass growth models, verified on a public dashboard. Investors gained clarity, while the local community benefited from job creation, infrastructure, and a share of token revenue.

How to Get Started

- Buy REDD+ Tokens on Verified Platforms: Use regulated exchanges to purchase, monitor, and trade tokens with verified project provenance.

- Seek Digital MRV: Demand projects that publish transparent, satellite-verified impact data for superior assurance and pricing.

- Understand Premiums and Buffers: Account for “buffer pool” escrow (10–15%) against reversals; higher integrity means higher price and lower risk.

- Pool Risk in Funds: Diversify across geographies, project types, and methodologies to smooth volatility and access bulk discounts.

Urban Regeneration Real Estate: 20% Cap Rate Boosts from Green Roofs

Grow Green, Grow Wealth—Rooftop Grassroots Return

It’s no secret that cities are heating up. What’s less known: green roofs are flipping the script, creating oases in the urban desert and, if you’re a multifamily investor, cranking up your asset’s value. In 2025, this isn’t just eco-theory—it’s a bottom-line opportunity.

Why Green Roofs?

- Climate and Cash: Green roofs reduce urban heat islands, stormwater runoff, and energy costs. In cities like Chicago, Toronto, and New York, regulatory incentives (tax rebates, expedited permits, and direct EPA grants) have created a gold rush for green roof retrofits in multifamily and commercial assets.

- Cap Rate Bump: Case studies consistently show green roofs increase rent premiums, boost occupancy, and shrink operating costs. According to recent Seattle and Portland data, multifamily green roof properties command up to 20% higher cap rates and a 3.1%+ rent premium compared to conventional assets.

- Policy Power: EPA “green bank” funding (spurred by the Inflation Reduction Act) in 2024 and 2025 unlocked $7 billion in capital for sustainable building retrofits, with green roofs a primary focus.

Real-Life Triumphs

- Sitka Apartments (Seattle): A LEED Platinum, green-roofed campus with rapid lease-up, high retention, and 40% lower energy use than peers.

- Brooklyn Grange (New York): A commercial green roof farm absorbing up to 80% of rainfall, cutting cooling costs by up to 25%, and drawing in high-end tenants.

Action Steps for Investors

- Target Municipally Incentivized Markets: Focus on cities with established green roof rebates, fast-track permitting, and density bonuses.

- Stack Benefits: Layer direct EPA/USDA grants, utility rebates, and local green financing for maximum ROI.

- Enhance NOI: Use green roofs to reduce energy/maintenance bills, boost occupancy, and defend rents in turbulent markets.

- Use Third-Party Certifications: LEED, Salmon-Safe, and similar credentials signal quality to renters and buyers.

- Monitor ROI: Most green roof investments deliver a 6-year payback with a 10–15% IRR over standard lifespans.

Circular Economy Regeneration Loops: Profiting from Closed-Loop Systems

Trash to Treasure—Make 12% Waste Work for 10%+ Yields

We live on a planet drowning in waste. Now, imagine owning part of the solution—where every item tossed becomes raw material for the next cycle, and your portfolio reaps the benefits. Enter the circular economy, where closed-loop systems convert 12% of waste into 10%+ investment yields.

Ellen MacArthur Models and Circular Economy Leadership

- Core Principles: A circular economy is regenerative by design; it eliminates waste, keeps materials at their highest value, and actively restores nature.

- Recycling Loops: Investment opportunities lie in companies and infrastructure that:

- Turn food waste into compost or biogas (for cities and agriculture)

- Remanufacture electronics and textiles (minimizing landfill)

- Recover plastics and metals for new product cycles.

- Ellen MacArthur Foundation: Their work offers proven models for closed-loop business, supply chain innovations, and measurable, science-based impact.

Financial Wins: Metrics and Returns

- Yields and Waste Conversion: Models show recycling or upcycling operations can turn 12% of input waste into 10%+ annual yields (especially attractive as raw material prices rise and landfill taxes soar).

- Economic and Social Multipliers: Every $1 invested in circular systems creates new jobs, reduces input costs, and compounds environmental savings.

- Policy Support: Governments in the EU and Asia are mandating higher recycled content, with grants and contracts up for grabs.

Real-World Success: The EU’s Circular Renaissance

Market leaders like Veolia, TOMRA, and countless startup platforms now dominate the resource-to-product cycle, with public listings and dedicated funds inviting investment. In closed loop construction, deconstructed steel, concrete, and timber is feeding a new build boom, with premium prices and IRRs ahead of traditional greenfield projects.

Actionable Steps

- Invest via Circular Economy Funds: Target funds with a track record of tech-enabled, closed-loop logistics, or direct project debt.

- Analyze Platform Metrics: Look at first-pass recovery rates, energy consumption per tonne, and customer contract quality.

- Participate in Crowdfunding Platforms: Smaller investors can access early-stage circular ventures via online platforms, often with 8–12% IRRs and transparent reporting.

- Monitor Policy Incentives: Stay abreast of grant cycles, public-private partnerships, and expanding “right to repair” rules driving demand.

Conclusion: Regenerate Your Money, Your World, Your Future

You’ve seen the evidence, you’ve felt the stories, you know the impact. Regenerative investing isn’t just a trend—it’s the blueprint for resilient profits, personal legacy, and global healing.

So, what will you regenerate with your next investment? Here’s how to begin:

- Choose one priority area—soil, sea, forest, city, or circular economy—and research top funds or projects.

- Evaluate investments with real data, rigorous verification, and clear, science-backed impact.

- Join a regenerative investing community—network, learn, and grow your action step by step.

- Demand accountability and storytelling from every product in your portfolio: get the story, not just the stat.

Ready to turn capital into renewal? Explore, invest, and regenerate your future, today. Want more personal stories, data deep-dives, and actionable regenerative investing tips? Subscribe now to GroundBanks.Com and unlock tools, reviews, and guides to make your money a force for good—and for gain.